MAKATI CITY, PHILIPPINES April 18, 2018 – “In the quarter when TRAIN’s first package was implemented and inflation rose to its highest since 2011, the office property market registered a strong start,” Pronove Tai International Property Consultants’ CEO, Monique Pronove said at the firm’s Q1 2018 Metro Manila Office Market Overview media briefing today.

Robust Office Market

Timely delivery of office supply with 250,000 sqm or 8 new buildings was completed in the first quarter of the year. This is equivalent to a 3% growth QoQ and 55% higher than the same quarter last year. Of this new supply,Taguig City contributed the most completions with approximately 106,000 sqm (or 42% of the total 1Q supply), followed by Quezon City (34% of total 1Q supply) and Mandaluyong City (16% of total 1Q supply).

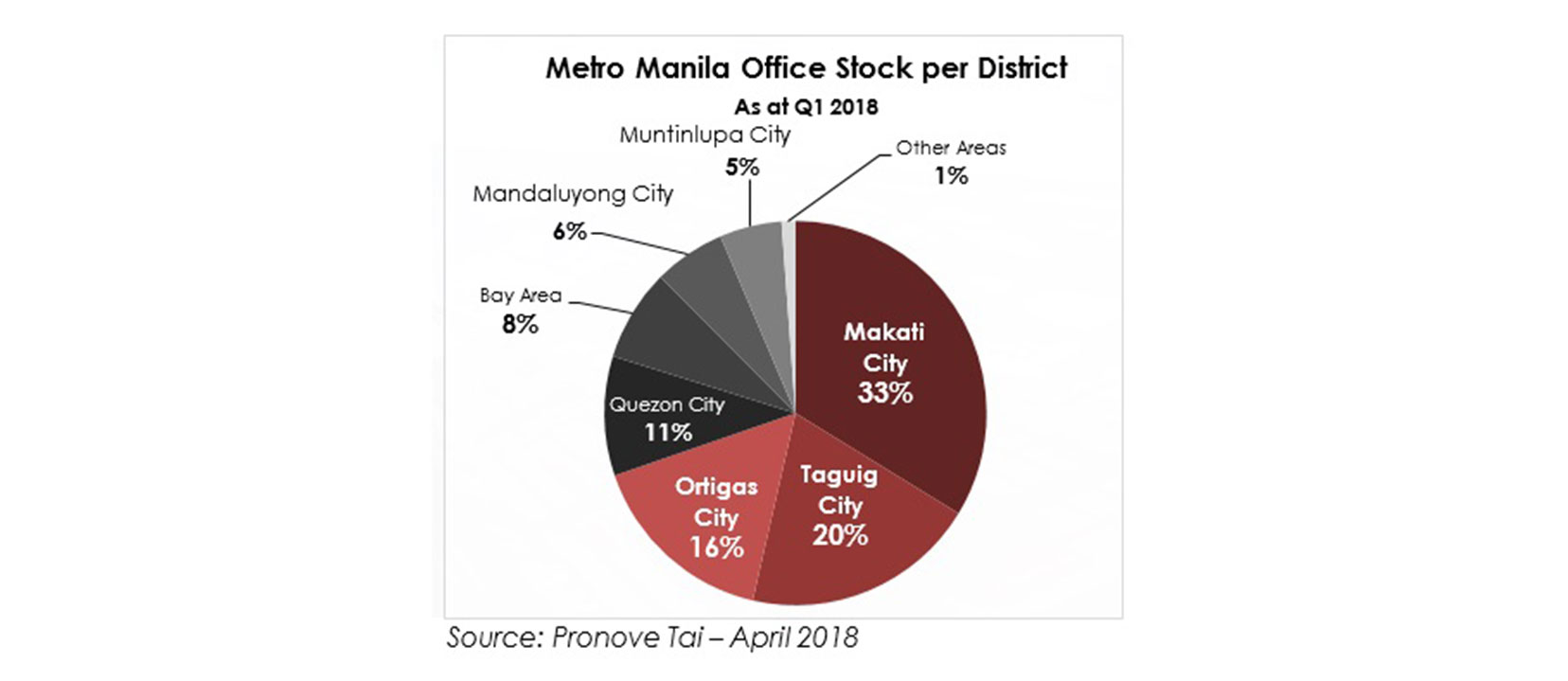

Total office stock for Metro Manila now stands at 10M sqm largely from the three office districts of Makati City, Taguig City and Ortigas Center.

Meanwhile, Quezon City recorded the fastest growth rate at 9%. “Bay Area which was the fastest growing district for the past 2 years, registered 0% growth or no new completions for the first three months of 2018,” Pronove noted.

QC Vacancy at a High 13%

While Metro Manila vacancy rate remained at a healthy average of 5%, Quezon City saw a rise in vacancy at 13% from 11% of the previous quarter. Mandaluyong City and Ortigas Center followed at 12% and 6% respectively.

Vacancy rate in Bay Area remained the lowest at only 1%. “As in the previous quarter, this tight stock for Pasay and Paranaque could be attributed to the aggressive absorption from offshore gaming corporations,” the Pronove Tai CEO added.

ITBPM Still King

The first quarter recorded a robust actual take up of 262,000 sqm. Still the office market’s biggest demand driver, ITBPM took up 51% of the available stock. Traditional offices recorded a robust 30% and offshore gaming corporations followed at 19% of the 1Q take up.

ITBPM, had a strong showing following the implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Package 1. “The first package had virtually no effect on the ITBPM. Their tax incentives remained intact for now, which allayed investor anxiety pre-launch and returned confidence in Q1,” Pronove said.

Rising Inflation

As at March 2018, inflation rose to 4.3%, the highest since 2011. “Inflation impact has a lagged effect and did not affect the 1Q property supply as construction materials were already procured. However, if the inflation rate continues to rise, indeed office construction activity will slow down in the next two years,” Pronove cautioned. “Construction cost would rise, prices and interest rates would increase, and ultimately, vacancy will grow.”

A Great Start

“The 1Q 2018 office market showed better performance compared to the same period last year as issues such as slow PEZA proclamations, contentious TRAIN discussions and clearer policies and better understanding of the POGO industry were addressed. Therefore, we urge for more careful and thorough discussions on socioeconomic policies as they greatly affect investor confidence.”