MAKATI CITY, PHILIPPINES April 12, 2019 – “The office sector had a strong start to 2019,” Pronove Tai International Property Consultants’ President and CEO, Monique Pronove said at their media briefing on Wednesday.

Increase in Supply, Despite Delays

Stock grew by 3% with 276,000 sqm supply in the first three months of 2019. Of the total stock of 10.9m sqm as at March 31, 2019, Makati City and Taguig City remained the two largest office districts. Meanwhile, third largest district Ortigas Center also recorded the fastest growth this quarter at 6% based on a 94,000 sqm completion. “This was from only one building – the Podium West Tower.”

“Despite a 30% delay in construction delivery, the office supply in the first quarter was still 31% higher than the quarterly average in 2018. We projected 21 building completions this quarter but only saw 15 buildings delivered,” Pronove explained.

Curbing Possible Cement Shortage

“The delay in building completion this quarter can be attributed to the cement shortage and if not immediately resolved, can lead to further delays throughout the rest of the year. There is an expected annual demand of 32 million metric tons while we only locally produce 25-27 million metric tons. The imposition of the temporary tariff on imported cement can lead to further delays.”

Mike Munoz, Pronove Tai International Property Consultants Research Manager

Demand Grows Significantly

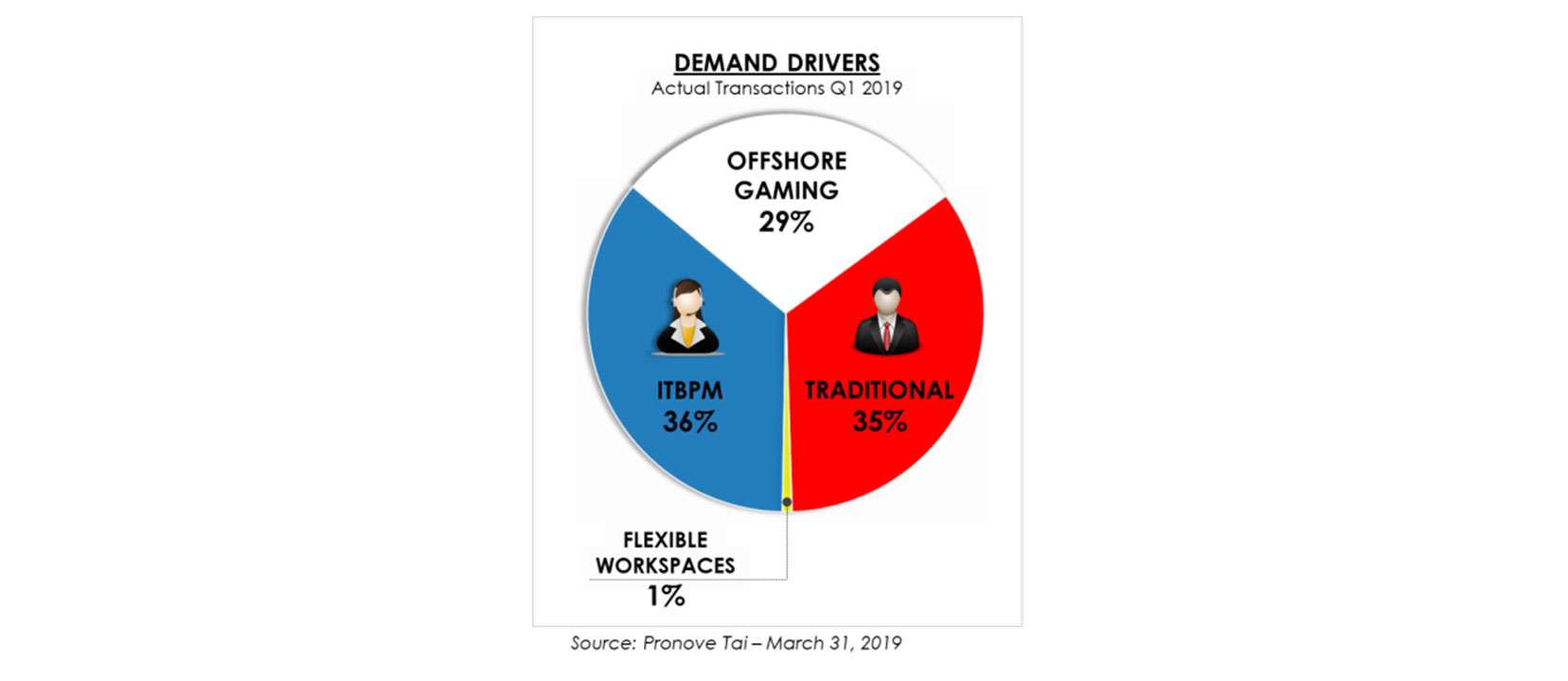

Actual transactions from January to March 2019 registered a 39% growth YoY, from approximately 260,000 sqm in Q1 2018 to 364,000 sqm this year. “ITBPM is still the top demand driver accounting for 36% or 130,000 sqm of the Q1 transactions. Followed by a strong 35% showing from traditional offices then Offshore Gaming at 29%,” Pronove continued.

Philippine Offshore Gaming Operators (POGO) demand recorded a 118% growth YoY. From last year’s 48,000 sqm Q1 takeup, the Offshore Gaming sector accounted for 106,000 sqm during the same period this year. “POGOs leasing behavior has evolved into pre-leasing (leasing before the building has been completed) to match their requirements. Since there is very limited available space in Makati and Bay Area, they have already ventured into locations such as Pasig and Paranaque.”

ITBPM, meanwhile, mostly took up space in Taguig City making it the top location in terms of demand share for Q1 at 31% or 113,000 sqm.

Manageable Vacancy

As at the end of March 2019, vacancy level in the metro is at 6%. “We consider 5-7% as the manageable vacancy for the office sector – just suitable allowance for expansion and growth for the companies within the building or the district.”

Quezon City and Mandaluyong City recorded the highest vacancy at 12% and 11 % respectively. Meanwhile, three districts such as Ortigas Center, Taguig City, and Muntinlupa logged a healthy 7%. Finally, Makati City and Bay Area had the tightest vacancy registering only 3% and 1% respectively.

Rental Growth

“In terms of rental rates, Makati City continued to record a 21% premium over Taguig City at an average of Php 1,590/sqm/month for All Grade A office buildings. This is an 8% rental growth for Makati City YoY.”

Strong Start to a Solid Year

“The significant increase in demand is a good thing for the industry but for ITBPM specifically, we recommend continuous upgrading toward high value services in the Knowledge Process Outsourcing sub-sector. This will help make our country competitive and enticing to ITBPM investments.

We continue to call on the government to fast track PEZA(Philippine Economic Zone Authority) proclamations,” Pronove concluded.